Understanding Moneywell Moneywell Personal Finance

MoneyWell is another personal finance software application built for the Mac. It’s sleek, it’s shiny, and performs like you would expect any good piece of Mac OS software to. MoneyWell uses the very effective envelope budgeting method (well, in this case, it’s a “bucket” budgeting method) to help you better manage your finances and plan for future expenses. Among other features, MoneyWell offers Direct Connect Banking and uses a single-window interface designed to simplify your experience with the MoneyWell software. So how does MoneyWell stack up to the other Mac-based competitors such as iBank, Snowmint’s Budget, and others? Hopefully this MoneyWell review and walkthrough will give you a better idea of what MoneyWell has to offer in terms of effective personal finance software.Note: This review is for version 1.4.12 of the MoneyWell software. Who’s Behind MoneyWell?

- Understanding Moneywell Moneywell Personal Finance Services

- Understanding Moneywell Moneywell Personal Finance Login

MoneyWell is produced by No Thirst Software LLC, a small company built by entrepreneur Kevin Hoctor. Kevin states that part of the mission of the company is to “deliver excellent products and services that change peoples lives.” Not a bad mission statement if you ask me.

And if there’s any avenue in which peoples lives can be changed, it’s certainly in helping them better manage their money and debt. I personally like that MoneyWell is produced by such a small company. This usually means that customer service is personable and often quick. Customer satisfaction is usually top priority in small companies such as No Thirst Software.

Also, the creator has a vested interest in the product, and as such, will be very focused on future improvements. Installing MoneyWell MoneyWell offers a free trial version of the software for you to test drive before you buy. The only limitation of the trial is that you can only enter 200 transactions. This should definitely be enough for you to see if you want to buy the software for good.

After clicking the Free Trial button on the MoneyWell website, you’re guided through the basic download and installation steps to easily install MoneyWell on your computer. After installing MoneyWell you’re given a couple of options to get started: I particularly like that they offer the option to import an OFX, QFX, or QIF file from another budgeting software application if you’ve been using one. Also, the sample file is a good way to click around and learn the system a little bit before diving in with your own transactions. Being that this review will try to give you a walkthrough-type view, I chose to start from scratch.Note: The MoneWell website has a good collection of tutorial videos to help you with learning the ins and outs of MoneyWell and getting started with your own budget. Be sure to check it out if you’re needing help.

Setting Up MoneyWell When starting from scratch, you’re prestented with this screen: Here you can see the overall look of the application (although it doesn’t yet have any data in it). We’ll go over the single-screen design in more detail a little later. Adding Buckets While this is probably pretty self explanatory, here you will check each “bucket” that you want in your budget. These buckets are the same as envelopes in other envelope-based budgeting software programs (you may want to consider these your “categories” of income and spending). Throughout your budgeting, you will add money to (through income) and take money out of (through spending) these buckets. You can change these later, but you should do your best to cover all of your expense categories here.While I didn’t see an option to create custom buckets in this step, I did see later on that you can add custom buckets by right clicking on a bucket (in the left sidebar of the appliation) and clicking New Bucket.

You can also click the “plus” icon beneath the bucket list. I was glad to see this capability since any effective budget must allow you to customize it to your specific spending needs. Adding Your Bank Accounts After adding your buckets, you’re taken to a screen to add your bank accounts. MoneyWell offers Direct Connect to your bank which allows you to automatically download your bank accounts as well as your transactions. You can also choose to add your bank account manually if you choose to do so (or if you have difficulty connecting with your bank).

Smoothly play all media discs including Blu-ray, DVD, VCD/SVCD, CD, DVB as well asBlu-ray Menu, ISO. Worlds No.1 Blu-Ray Player! Key Features: 1. Gom mvp player download software for mac.

It wouldn’t let me connect with my bank (Chase). After digging around a bit, I found that Chase charges $10/month to allow direct connect with personal finance software.

Looks like I’ll be adding my accounts and transactions mannually (which is fine with me — I actually think it helps reinforce the monitoring of your spending habits). MoneyWell’s Single-Window Interface MoneyWell does a pretty good job of introducing you to the single-window interface that it uses.

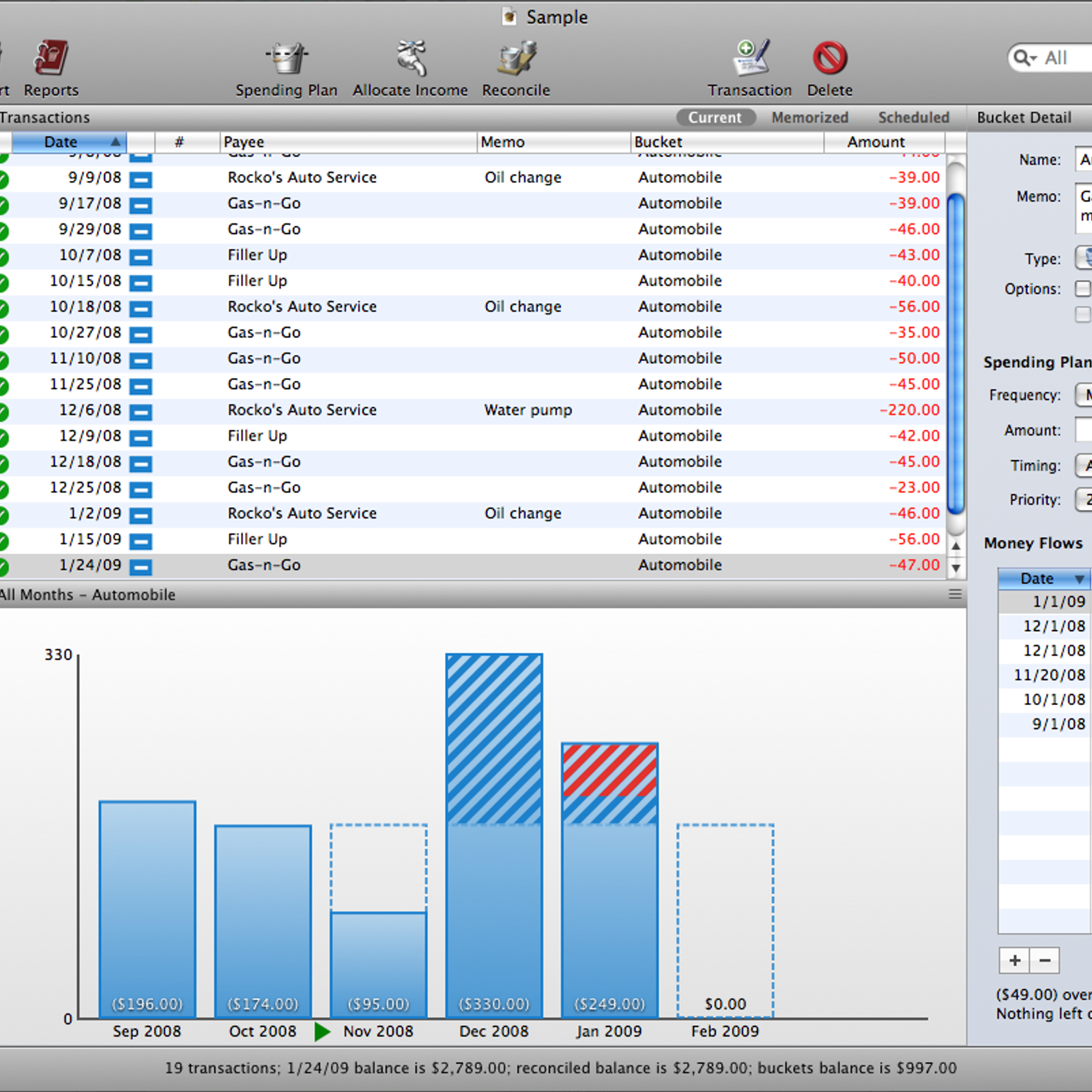

Here’s the screenshot that they provide on their website: I see this as a total matter of personal preference. Some will really like the single-window plan, while others may see it as a bit crowded for so much information. I don’t think it’s crowded per se, but I could see the benefit of having a separate windows for transactions (allowing more space for more historical budget/spending information without having to click to each separate bucket). Draw the Fill Line: Setting Up a Spending Plan Once you’ve added your bank accounts to MoneyWell, you’re now ready to set up your Spending Plan (also known as a budget). MoneyWell refers to this step as creating “fill to here” lines on your buckets. Basically you are noting how much money you will need to spend during the month from each bucket. You can create your Spending Plan by clicking on the Spending Plan button at the top of the MoneyWell screen.

You’re presented with this screen: If you’re just starting out with MoneyWell, you will enter in the “Planned” amount for each bucket. You can set the Frequency and Timing for each bucket as well.

If you have a number of past transactions already in MoneyWell (if, for example, you imported a larger file from another personal finance software application), you can choose to calculate your spending plan by your past history. Data entry into this Spending Plan was quite easy. At first I was frustrated that I couldn’t tab through the fields to enter the numbers quickly. But I soon found that by hitting Enter on the keyboard after each entry, it takes you down to the next bucket’s Planned field.

You can thank me later for saving you loads of time with that little tip. Fill the Buckets: Allocating Income Once you’ve set up your spending plan (told each bucket how much money you need in it), you can now allocate the money that you have in your bank accounts to your buckets.

Understanding Moneywell Moneywell Personal Finance Services

If you’d like to start by allocating the beginning balance of your bank accounts, you’ll first need to designate the Starting Balance “transaction” to be used for your Salary bucket. One way to do this is to click on the transaction and then choosing Salary from the Bucket drop down list in the Transaction Detail section. You’ll then see that your Salary bucket shows that amount next to it. Now, you can mannually allocate money from your salary bucket into your expense buckets by clicking and holding on the Salary bucket and then dragging your mouse over an expense bucket and releasing. In the box that appears, type in what you’d like to allocate, and click Add.

By clicking on the Allocate Income icon ( ), you are given this screen: The numbers in the far right column show the amount to be allocated to the respective buckets. These are determined by your spending plan settings (you’ll notice that the numbers are half of what the “planned” column shows.

This is because I have my income set to come twice a month (hence the buckets will be filled with half the planned amount, twice during the month). You can change the allocated amount by double clicking in the cell and changing the number. You can also prioritize the expense from Lowest to Highest. This will help with allocating your income and making sure that your most important expenses are always paid.

After allocating your income you will see the balances of each bucket in the left sidebar. See the following screenshots. Empty the Buckets: Adding Transactions There are a number of different ways to add transactions in MoneyWell. As already mentioned, you can use Direct Connect to automatically download transaction data. If, for whatever reason, you don’t use Direct Connect, you can either upload an exported file from your bank or you can add each transaction mannually. We’ll look at both.

Enter Transactions Mannually Entering transactions mannually is fairly easy. You can new transactions by clicking the Transaction icon ( ). You can then tab through most of the important details in the Transaction Detail section (on the right side of the screen) and enter as you go. I like that for most transactions you won’t need to use your mouse much while entering the data (unless you want to use the Status feature). At first I was disapointed that you needed to use your mouse to click the transaction icon for each new transaction. But then I happened to try hitting Command + N on the keyboard and it did just what I had hoped: it started a new transaction. Trust me, this will save you loads of time if you’re entering all your transactions mannually.

Importing Transactions If you’re looking for a quicker alternative for entering your transactions, you download your transactions from your bank and import them into MoneyWell. The file needs to be either an OFX, QIF, or CSV file, so make sure your banks can export one of those file formats (most banks will).

After downloading the file from your bank’s website, simply click the Import icon ( ) and select the file. After choosing a date format that will work with your file, click “Import” and your transactions should show up in your transaction history. The one thing that you will need to do here is go through your imported transactions and specify which bucket each transaction is for. Moving Money in MoneyWell Moving Money Between Buckets You’ll sometimes find that you’ve overspend in a certain category.

Since you’re using the envelope budgeting methodology, you’ll have to take money from another category to be used to cover the overspent amount. Doing so in MoneyWell is fairly easy. Just as you do when you alocate money from your Salary bucket to your expense buckets, you can just “drag and drop” money from one bucket and put it into the other. For example, in the screenshots below I had overspent in my Gifts category by $56.63 (I had $30 in the bucket to spend, but I became too generous and spent $86.63). To cover the overage, I decide that I can take money from my Vacation/Travel bucket.

By clicking the Vacation bucket and dragging it to the Gifts bucket, I can choose to add the $56.63 to make it even. See the screenshots for a play by play of how that happens. Moving Money Between Bank Accounts When you transfer money between your bank accounts (for example, from your Checking to Savings), you’ll want to record that as a transaction.

Moving money between bank accounts, however, is just as easy as moving it between your buckets. Using the same drag and drop technique that’s outlined above, simply drag money from your checking account onto your savings account. Then simply fill out the amount you want transferred and click Add. If you want the amount to be shown in a bucket (in this case, Savings), you may designate a bucket for that transaction. Reconcile Bank Accounts Another little feature that some may find handy is the help MoneyWell gives when reconciling your bank transactions.

It’s fairly self explanatory and easy to use, so I won’t say much here. But here’s a screenshot in case you’re interested: I’m not sure that we need a whole new reconciliation screen for this, but the visual aids will be helpful for some. The only thing I would add in terms of account reconciliation is the ability to do it directly from the regular transactions screen by clicking the circle to the left of the transaction to mark it as cleared. Reports The Reports section in MoneyWell may not be what most people might expect. What some other personal finance software programs call reports are actually graphical representations of their spending information. Being that MoneyWell shows much of this graphical representation in the main screen (determined by what you have selected at any give time), MoneyWell doesn’t have a separate graphical analysis area. MoneyWell’s Reports are basically a number of different data tables showing your spending information.

While these may useful to some, I personally prefer a larger set of graphs to choose from. Granted I may not have enough data (or rather, data over time), to really appreciate the graphs that MoneyWell provides, I’ve found other applications to have better spending analysis capabilities via their various reports and graphs. Other Notable Features MoneyWell offers a number of other features that aren’t covered in detail in this review.

You can read more about them on their website, but I thought I’d mention a few here. Scheduled Transactions. Search Bar. “Memorized” Transactions. Smart Buckets. Copy to Excel or Numbers MoneyWell Price MoneyWell costs $49.99. They offer a free trial (you can enter up to 200 transactions) so you can get a good feel for what it has to offer before buying it.

If you find that MoneyWell helps you manage your money better, $49.99 is a small price to pay. Money Back Guarantee If you purchase MoneyWell and then later decide that it’s not for your, you can get a full refund up to 60 days after purchase. No questions asked. This is a solid guarantee that I believe the company will stand behind.

Conclusion MoneyWell uses the solid envelope budgeting methodology that has helped people get a handle on their finances for years. The MoneyWell system utilizes this methodology well. I would like to see a little more encouragement for the users to “budget to zero.” Currently it’s a little too easy for users to leave a chunk of money unbudgeted in their Salary bucket. So if you use MoneyWell, make sure to stay disciplined and get to as close to a zero-based budget as possible. The MoneyWell software was clean and professionaly developed. I found no bugs and only a couple of areas that I thought could have used some usability improvements. Data entry was quite simple and fairly quick.

As far as the software goes, it felt very solid. In terms of effectiveness, MoneyWell will get the job done with it’s budget “buckets.” I was left wanting a little more in terms of reports and graphs, but those things aren’t the main features that most will look for in personal finance software. All things considered, if you try MoneyWell and find that it works for you, go for it.

While I may still have other favorites above MoneyWell, it’s a solid budgeting tool that, if used correctly, will help you shed debt and increase your savings.

Advertisement Keeping track of your If you want to get ahead in life, personal finance is a necessary skill. Make sure you up to speed with these awesome free eBooks.

Can be a hassle, especially if you have a lot of accounts or you run a small business. There are some great When it comes to online budgeting and expense tracking, there are plenty of solutions, but two of the biggest names in the business are Mint and You Need a Budget (YNAB)., but many people prefer to have dedicated software on their home computer to keep track of everything. Quicken is the biggest name in the business, but what else is out there? These five apps will help you budget, keep track of spending, and monitor your investments from your Mac. ($35 / $70) It might not win any aesthetic awards, but Moneyspire is a fast and versatile personal finance client. Its strengths include direct connection to your bank, a Reminders view that keeps you on top of upcoming bills and paychecks, multiple-budget support, and balance forecasting (though it’s not clearly explained how this is done; it appears to just look at recurring transactions, so it might be a rather simplistic forecast).

Moneyspire also lets you use If you've sent money abroad or exchanged currencies before a vacation, you probably got a poor deal. Here are some better alternatives to banks and currency exchanges.

On your accounts, which will be really useful for anyone who’s moved to a different country or does business internationally. The interface isn’t especially striking, but it’s very easy to navigate quickly. There aren’t many downsides to Moneyspire, but some of them might be deal breakers.

Understanding Moneywell Moneywell Personal Finance Login

The Reports tabs aren’t especially insightful; they show you your cash flow, tax-related cash flow, expenditure by category, and net worth over time. Not every bank is available for Direct Connect, and you’ll need to make sure your accounts allow Quicken-style access, which could cost money.

And PayPal isn’t supported. Also, you only get Direct Connect with the premium version of the app, which costs twice as much.

The basic version requires that you download your transactions manually. Moneyspire seems like a good option for people who run small businesses and want to use the same software for both home and business accounts. Being able to create multiple data files and multiple budgets within each file means you can manage a lot of different financial information at once.

($60) Formerly called “iBank,” Banktivity 5 is a powerhouse of a personal finance app. Some of its most notable features include very nice-looking, print-friendly reports, support for multiple currencies, easy attachment of images to any transaction for These receipt scanner apps will help you scan, save, and organize every receipt for your personal or business needs., financial quotes, many investment-related capabilities, and key facts in the Overview. Although you’ll need to have a subscription plan (for $40 per year) to get direct, automatic access to your bank accounts, Banktivity makes it easy to download and import your transactions directly within the app. To make sure all of your accounts are displaying the right amount, though, you might need to do some extra work compared with automatic downloads. Banktivity also has a great budget-creation wizard that walks you through setting up budget for income, regular expenses, unplanned expenses, bonuses, unscheduled income, and more.

Creating multiple budgets could be useful for multi-person families or small business owners, and the option to budget in the “envelopes” method, much like You Need a Budget (a Does your checking account remind you of a debt-burdened Southern European nation? You Need A Budget. We know it's tough to keep track of spendings. YNAB can help. Around here), provides another good way to keep track of your money.

Like Moneyspire, Banktivity is probably best for people who have complicated budgeting and tracking needs; if you do a lot of investing in different places or run a small business, for example. The price tag combined with the subscription fee for automatic updates on your accounts can add up quickly, and likely won’t be worth it for the average user. ($50) If you like the overview that your checkbook register gives you of your transactions, you’ll like Moneydance’s transaction screen, as it’s styled after the log you might be familiar with. Other features include automatic transaction downloading and categorization, online bill pay, a nice overview screen, good support for investments, and useful reports and graphs. The inclusion of exchange rates on the overview screen is a nice touch for users with international accounts, too.

The investments screen is especially nice, as it gives you a lot of useful information in a small space. By automatically downloading investment information, you’ll always have the most up-to-date information on your stocks, bonds, and other investments, as well.

The wide variety of views, including charts and graphs, is really nice, and can easily be accessed with a couple clicks in the sidebar. Overall, Moneydance doesn’t have many downsides. Because I was working with a free trial, I couldn’t use its ability to connect to a bank, so I had to download and import my transactions, which was kind of a pain, but I was able to get a good overall idea of how to use the app. The price will still be prohibitive for many users, making this, like the other choices, best for people who want an all-in-one solution for multiple accounts and different subsets of accounts. ($60 / $30 during Preview Sale) Fans of You Need a Budget will like MoneyWell; the layout is very similar to YNAB’s online client, and budgeting works in the same way.

The The world of online shopping evolves so quickly, it can be hard to keep up with the terminology. Here are a handful of terms that we think everyone should know for their own good! Is one that’s been around for a long time, and has worked for a lot of people, so there’s a good chance that MoneyWell’s system will work for you. The income/expense graph that can be displayed at the bottom of the transaction screen is a very convenient way to see how your monthly cash flow has been going, which is always a good thing to have front and center. MoneyWell’s interface is really nice — possibly the nicest of all the apps reviewed here. While it doesn’t display quite as much information as some of the other options, it’s very clean and easy to read, and it doesn’t look like it was designed in the 90s.